Bitcoin

Defi

The ProblemOnly 1.3% of all Bitcoins can access DeFi

BTC currently accounts for almost half of the crypto market cap. But, because BTC doesn’t support smart contracts, it has limited presence in DeFi markets.

Until a simple, convenient and secure way is found for mainnet BTC to support DeFi, the utility of the leading cryptocurrency is negligible. Unlocking the direct use of BTC in DeFi unleashes 100x growth potential for the crypto space (and perhaps even more!)

The SolutionA New DeFi Programming Paradigm

Combining HTLC and game theory, BCDEx allows P2P asset exchanges between Bitcoin and EVM compatible blockchains.

BCDEx is building a DeFi ecosystem that is different from Ethereum smart contracts by enhancing security, reducing reliance on the blockchain, and optimising transaction processing methods.

Read the docs

Read the docs

No middle-man, truly decentralised

No additional validators involved, no oracle dependency, no custody, no liquidity pools.

Funds remain in wallets until the transaction occurs

Forget about DeFi attacks

Thanks to HTLC’s asynchronous nature, there's no risk of common DeFi attacks: flash loan, reentrancy, double confirmation.

Price manipulation is a thing of the past

No blockchain bloat

In smart-contract-based DeFi all state operations must be gathered on-chain, making it bloated.

In the BCDEx network, only final settlement is on-chain, leading to smaller block sizes.

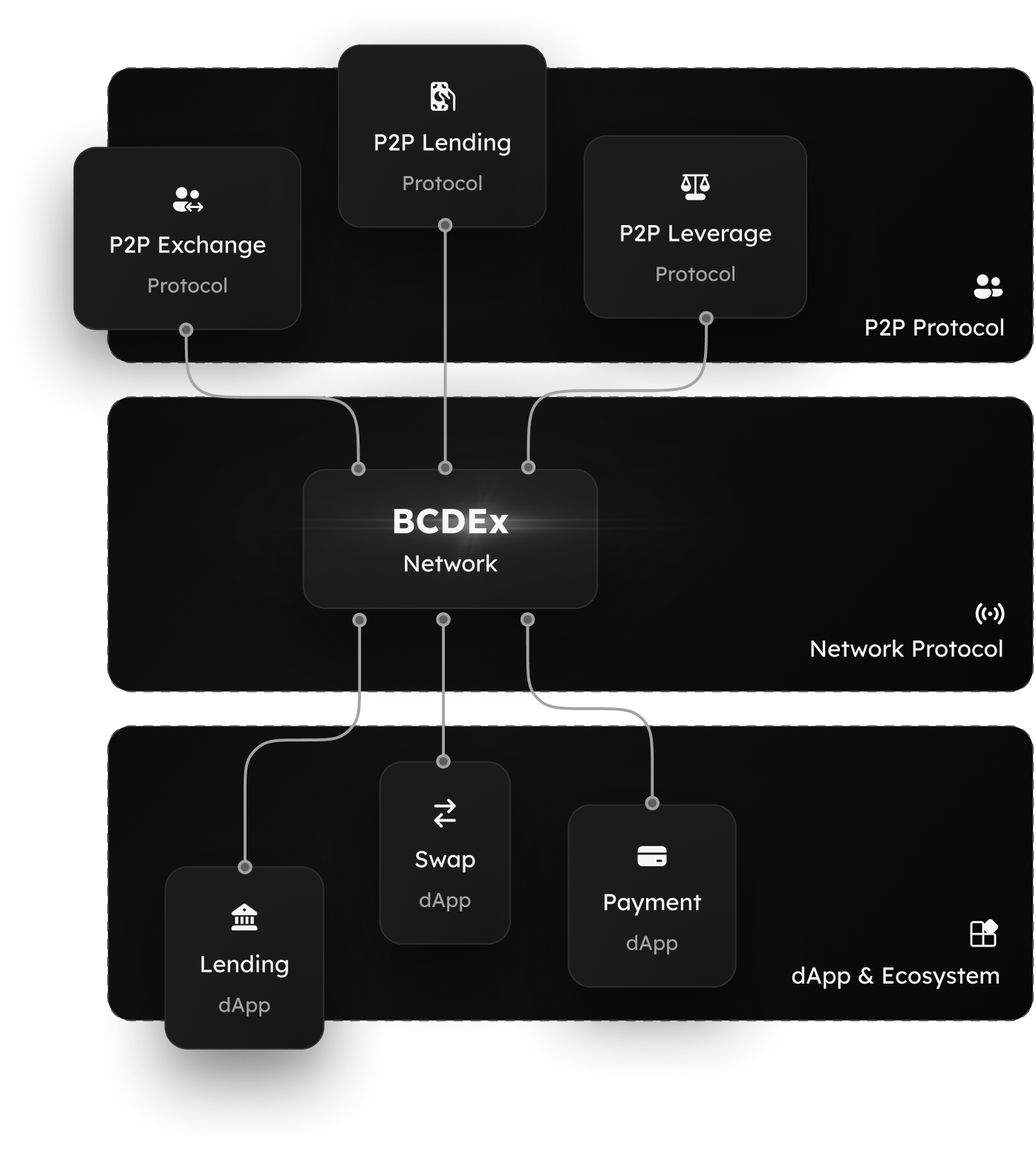

How does it work?3-Layer Architecture

Peer-To-Peer Protocol Layer

Decentralised non-custodial transactions using game theory dynamics and atomic swaps.

Network Protocol Layer

Market makers are introduced as active nodes, connecting different blockchain ecosystems and forming the fully-automated BCDEx network.

dApp & Ecosystem Layer

Developers can easily build an entire ecosystem of dApps, finally unlocking the full potential of DeFi.